Financing costs

This may be the cost we care about

LFXs on FX, indices and commodities

If you have an open position on your account at the end of each trading day, the position is considered to be held overnight and subject to either a financing charge or credit to reflect the cost of funding your position (in relation to the margin utilised).

The financing cost is calculated on a per position basis and may be a charge or a credit to your account, depending on whether you hold a buy/long position or a sell/short position. The financing charge or credit also takes into account the impact of our admin fee.

Funding rates for LFX positions

FX and metal (except copper):

Daily financing charge or credit = size of position x applicable funding rate/DAYS**.

Indices and commodities (including copper):

Daily financing charge or credit = value of position^ x applicable funding rate/DAYS**.

Funding rates (or ‘swap rates’ for FX products) vary depending on the instrument and may change on a daily basis. These are quoted as an annual rate. Each instrument has two quoted rates: one for a buy/long position and the other for a sell/short position.

A negative funding rate will result in a charge being debited from your account, and a positive funding rate results in a credit into your account.

How we calculate funding rates

The below table shows how we calculate funding rates for our FX, metals and indices LFXs.

Financing costs affected by holidays and weekends

Different asset classes settle on different days.

FX and metal (except copper) trades typically settle on a T+1 basis, which effectively means that weekend financing is usually applied two days earlier on Wednesdays (tripling the usual daily rate), although this timeline is similarly impacted by public holidays.

Indices and commodities (including copper) typically factor in weekend financing on a Friday (tripling the usual daily rate), although this timeline is also similarly impacted by public holidays.

Accordingly, the actual funding rate on any given day may reflect more than one day’s costs.

No financing charges or credits are applied to clients’ accounts over the weekend.

LFXs on commodities (plus copper)

NEXUS FINTRADE (Beta)’s commodity LFXs (including copper) do not have an expiry date. To achieve this, NEXUS FINTRADE (Beta) generates its commodity LFX price by applying a premium or discount rate (called the "basis rate") to the price of the underlying active futures contract.

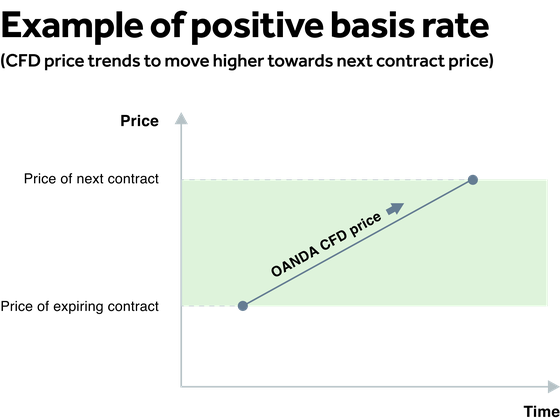

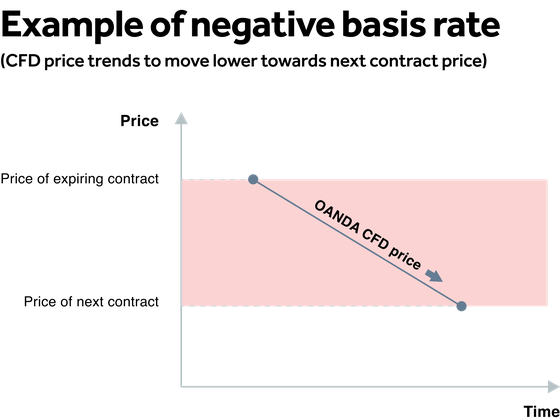

When a futures contract is near its expiry, the basis rate for the next contract is calculated using the prices of the expiring contract and the next contract. This application of the basis rate causes the LFX price to converge towards the active future contract price as the active futures contract approaches its expiration date by moving the LFX price either higher or lower. The direction of this movement is determined by the price of the active futures contract and the LFX price. For example, if the price of the active futures contract is higher than the LFX price, the application of the basis rate will cause the LFX price to move higher to converge towards the active futures contract.

The funding rate applied on commodities at the end of the trading day is intended to offset the price movements created by this pricing methodology, and as such could be a credit or debit depending on whether you are long or short and whether the price movement is positive or negative and the impact of the additional admin fee.

Financing charges or credits are calculated as follows:

Financing charge or credit = size of position x applicable funding rate x [trade duration (in days) / DAYS**] x conversion rate to account currency.

NEXUS FINTRADE (Beta) charges financing on commodity (including copper) LFXs using the basis rate with a % admin fee applied.

For long positions, your account will be debited the basis rate plus a admin fee. For short positions, your account will be credited the basis rate minus a admin fee (which could result in a charge where the basis rate is less than the admin fee).Please check the deduction record details for the actual interest rate. If you have any questions, please contact the platform in time.

Last updated